The debate over Bitcoin has been largely about whether it is gold or a gray stone. Perhaps it would be interesting to look at it more economically. So let’s think of bitcoin as a global business that’s worth more than twice the companies on the Oslo Stock Exchange.

The number of competitors is constantly growing, all the expertise that underpins the business is openly shared with everyone

Admittedly, the business is without income, has no employees, no management and is established by strangers. On the other hand, business is being developed and promoted by enthusiasts without being paid, and it has attracted millions of owners and tremendous interest.

Tori Roras. Photo: Annalysis Mason

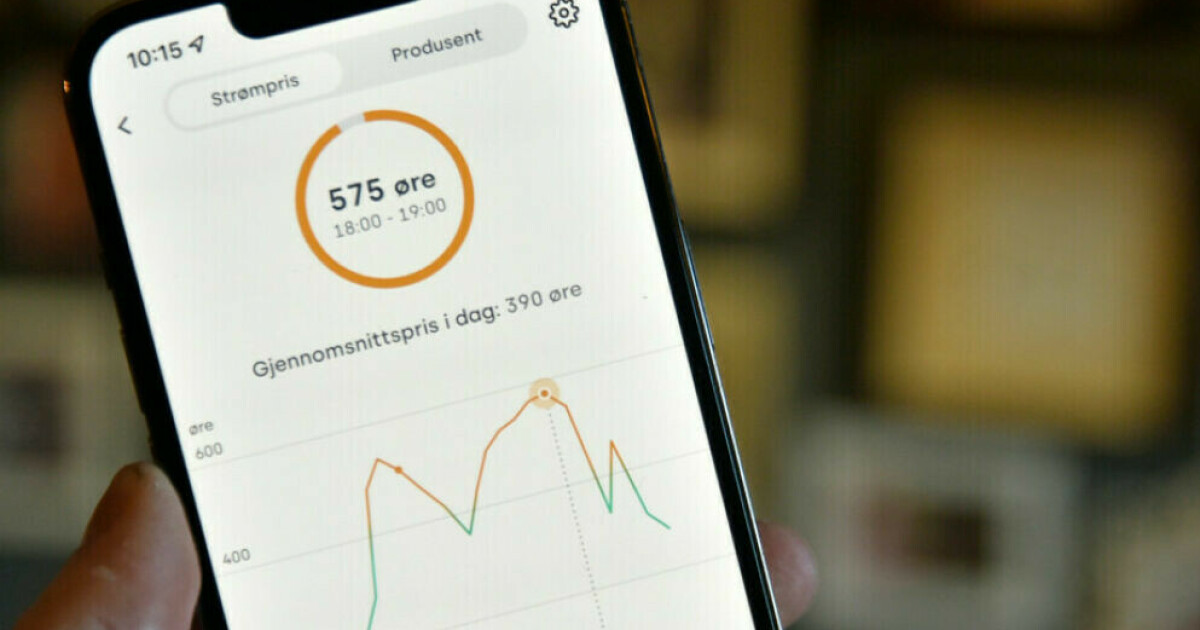

The company has never invested in any means of production or assets, but it has a large-scale operation that requires the company to issue new equity shares every day for more than a quarter of a billion kroner. Equity shares are awarded to suppliers worldwide, whose costs can be up to NOK 200 million per day to cover work performed.

The business idea of the company is that the collectibles can easily be used to buy and sell goods and services around the world, but this is somewhat uncertain, in part due to the fact that the company after its inception in 2009 has acquired more than 10,000 competitors. The number of competitors is constantly growing, all the expertise that underpins the business is openly shared with everyone.

With the original business idea so uncertain, many believe that the company’s name and location – and also a very positive historical development in the equity price – is the basis for value that is likely to rise further.

The company was previously scheduled to issue fewer shares, and plans to issue the last in about 120 years, unless the enthusiasts developing the company change their minds within it. It so happened in the past that there was a dispute over the development, which led to the division of the business.

The company’s shares are traded in markets that are often managed by the company’s major owners. There is little independent control over the buying and selling of units, and the markets are not regulated by public authorities. Units are often deposited with online companies on an uncertain basis, and it is not uncommon for units to be forgotten or stolen.

With so many weaknesses in the business economics perspective, it is simply amazing that bitcoin has achieved something close to the world record in value development for early adopters. For my part, I am passionately pursuing the path forward without owning bitcoin or something, and without answering whether bitcoin is gold or a gray stone in the long run.

Tori Roras

Partner I Analysys Mason

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”