Despite the pandemic, Neptune Energy was able to complete the new Duva satellite field on time and under budget. The field starts after oil and gas prices have brought about a significant drop.

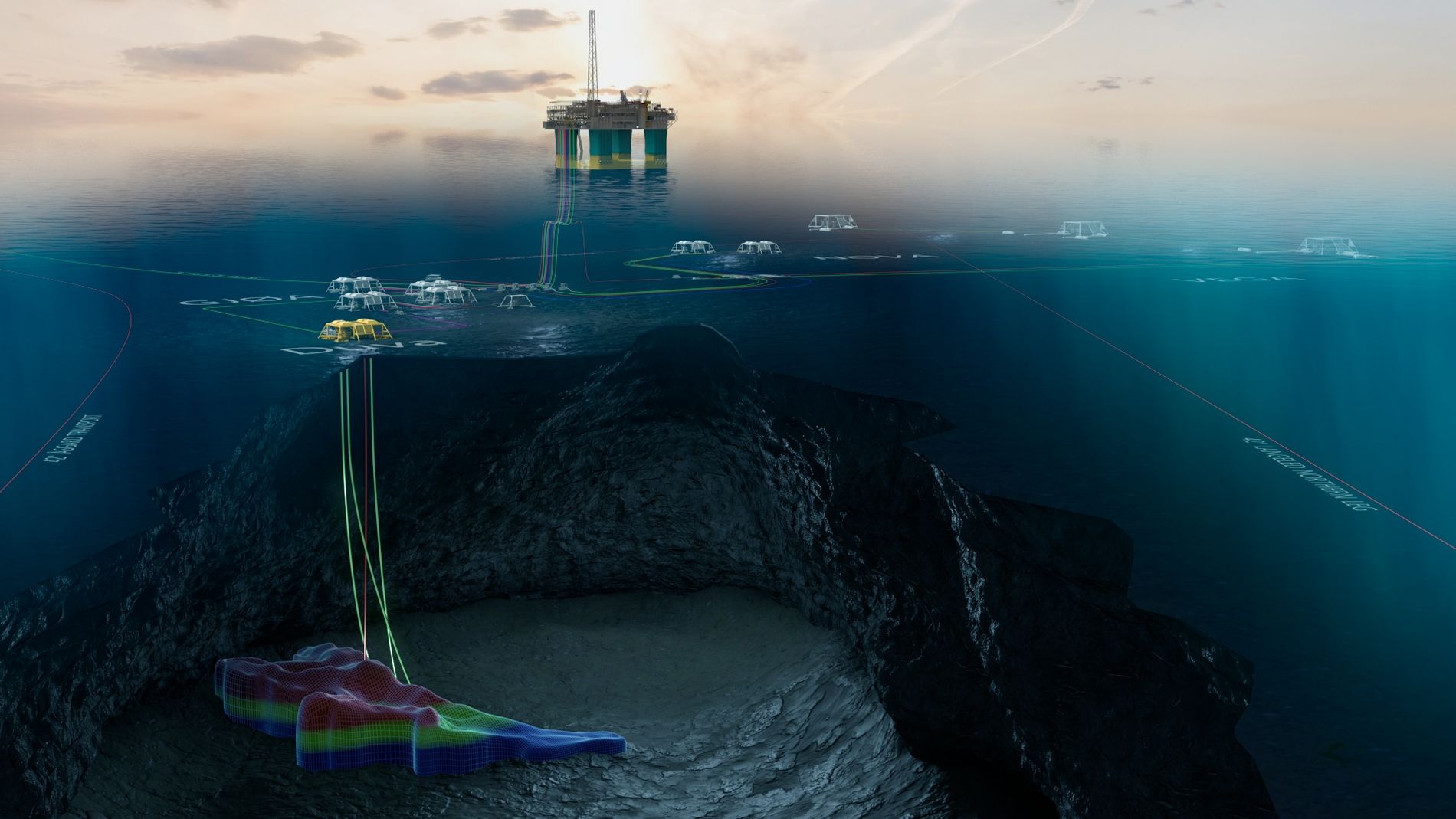

Illustration of the new subsea Duva field, a satellite of the Gjøa platform.

The timing is very appropriate. When you start in an area like this, with relatively short plateau production, timing is very important to the project’s finances, says Odin Estensen, CEO of Neptune Energy to E24.

At 17:00 on Sunday afternoon, production officially began at the Duva oil and gas field, a satellite of the Gjøa platform in Neptune in the northern part of the North Sea.

Neptune Energy is the operator of Duva (with a 30 percent stake), while the partners are PGNiG (30 percent), Idemitsu (30 percent) and Sval Energi (10 percent).

In total, the field is estimated to hold 71 million barrels of oil equivalent, of which 56 percent is gas and the rest is oil.

Oil is sent from the field via a pipeline via Troll to Mongstad, while gas travels through the pipeline to the St Fergus terminal in the UK.

Duva’s start-up comes after Neptune began production on the Gjøa P1 project in February, which is an expansion of the Gjøa field. Together, the two projects provide an additional 120 million barrels to the Gjøa area.

CEO Odin Estensen, Neptune Energy

Expansion of the discovery was sought from 2016 and approved in 2019. Production was actually supposed to start in the first quarter, but it has now started in the third.

– Overall, we are very satisfied, given the challenges that the Corona pandemic has presented to all projects on the Norwegian shelf, says Estensen.

Despite being a little behind schedule, you’re way short of budget.

In the state budget as of October last year, it was estimated that the Dova field would cost NOK 417 million less than the original estimate of NOK 5.6 billion – a saving of 7 percent.

– We ended up with a total of NOK 5.5 billion, but it also includes an additional production well that we decided to drill and was not included in the original PDO estimate, says Estensen, referring to the development plan.

Read also

Calculation: No more than half of Norway’s oil is produced

Production from the Duva field comes here to the Gjøa platform.

The largest development contracts went to:

- Rosenberg Verft (Worley Parsons) – who was responsible for modifications to the Gjøa platform to receive the Duva production

- TechnipFMC who supplied pipelines and subsea systems

- Odfjell who stood with the drilling rig who drilled wells

- Schlumberger who provided drilling services

How has the epidemic affected development itself?

– We developed the Duva and Nova fields at the same time. This means that you depend on the beds on the Gjøa platform. When the pandemic hit, we had to reduce the number that could be on Gjøa at the same time, so we had fewer hands that could operate than otherwise, says Estensen, adding that the pandemic has also caused challenges for rigs and other ships.

Read also

Lysbakken denies any compromise on the red and green oil: – There were no such meetings

hot market

The domain starts in a very profitable market.

Before the summer of last year, oil prices were under $20 at worst during the pandemic, and have risen from about $45 to $66 a barrel in the past 12 months.

In the UK, gas prices soared this summer to their highest level in 15 years.

– Did you dream of a better time to start the field and good additional production?

– The additional production well was set before we saw the biggest price hike, so maybe a bit of luck. Estensen says the timing of the project is very appropriate.

Actual plateau production will last for two years, while production from the entire Dova field is estimated to last about 10 years.

– When you now get good additional production, does it reduce the life of the field?

– No, but we can speed up production so that we can boost the economy in the project. The well also gives us increased flexibility when it comes to practical challenges, and the additional well has made it possible to maintain the schedule on the project, Estensen says.

It states that Dova oil has a waxy content that makes processing more demanding. But by producing at a higher rate, you can also maintain a higher temperature and reduce the wax problem.

Read also

Norwegian Petroleum Directorate on the tax package: – Projects may have been completed anyway

I hope to stay cook until 2040

The Duva and Nova fields help extend the life of Gjøa by five years. Gjøa went live in 2010 and Neptune aims to keep the platform operating until 2040.

– It is very important to always be hooked on new resources and extend the life of the type of infrastructure we have in Gjøa, says Estensen.

He says they still have some work to do to reach the 2040 goal.

According to Estensen, since Gjøa is electrified, it is attractive to invest in the field and nearby discoveries.

– Duva gives us profitable drums with extremely low CO2 emissions. We’re talking about three kilograms of CO2-equivalent per barrel and see our investment going toward fields that have the potential to generate electricity, he says.

Read also

Aker BP did not find oil in Stangnestind: it could mean the end of the company’s exploration in the Barents Sea

In the Gjøa region, Neptune is now maturing the horizons of Ofelia and Hamlet.

– These are the best possibilities we are looking at right now. In addition, Aurora, Peon and Grossbeak have been found by others that may also be candidates for contact with Gjøa, Estensen says.

At the top of the Gjøa region, Neptune is also maturing the Dugong discovery into development.

What kind of development will it be and will it meet the deadline in the oil tax package at the end of 2022?

We consider it either a stand-alone development or associated with another field in the Tampin area. Estensen says we’ll likely have Dugong ready by the tax package deadline.

The discovery, estimated at between 40 and 108 million barrels, will now be tested with a production well during the fall, in addition to the drilling of another exploration well.

– We also have some other projects and electrical measures in the licenses where we are partners that could be part of the package, continues Estensen.

Read also

Martin Laing begins: Searching for more oil in the neighborhood

Owners follow Norway closely

– How do the foreign owners view the prospects of the Norwegian shelf and the oil controversy that is taking place in the election campaign now?

– They’re following closely, there’s no doubt about that. But so far, they have been very pleased with the Norwegian continental shelf and relatively stable frame conditions. Estensen says they see Norway as a good place to live.

He points out that Norwegian businesses make up about half of Neptune’s global portfolio, and are doing well in terms of profitability and CO2.

We also have excess gas in our production, about 70 percent, which we think is important in the current situation, where we are in a transitional phase and where gas will be a very important source of energy in the future.

Read also

Oil industry euphoric, environmental movement desperate

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”