On Wednesday, crisis-hit Evergrande’s deadline to pay $47.5 million in interest expired. Lenders should not have paid.

For the second week in a row, Evergrande Real Estate will not have paid the dues.

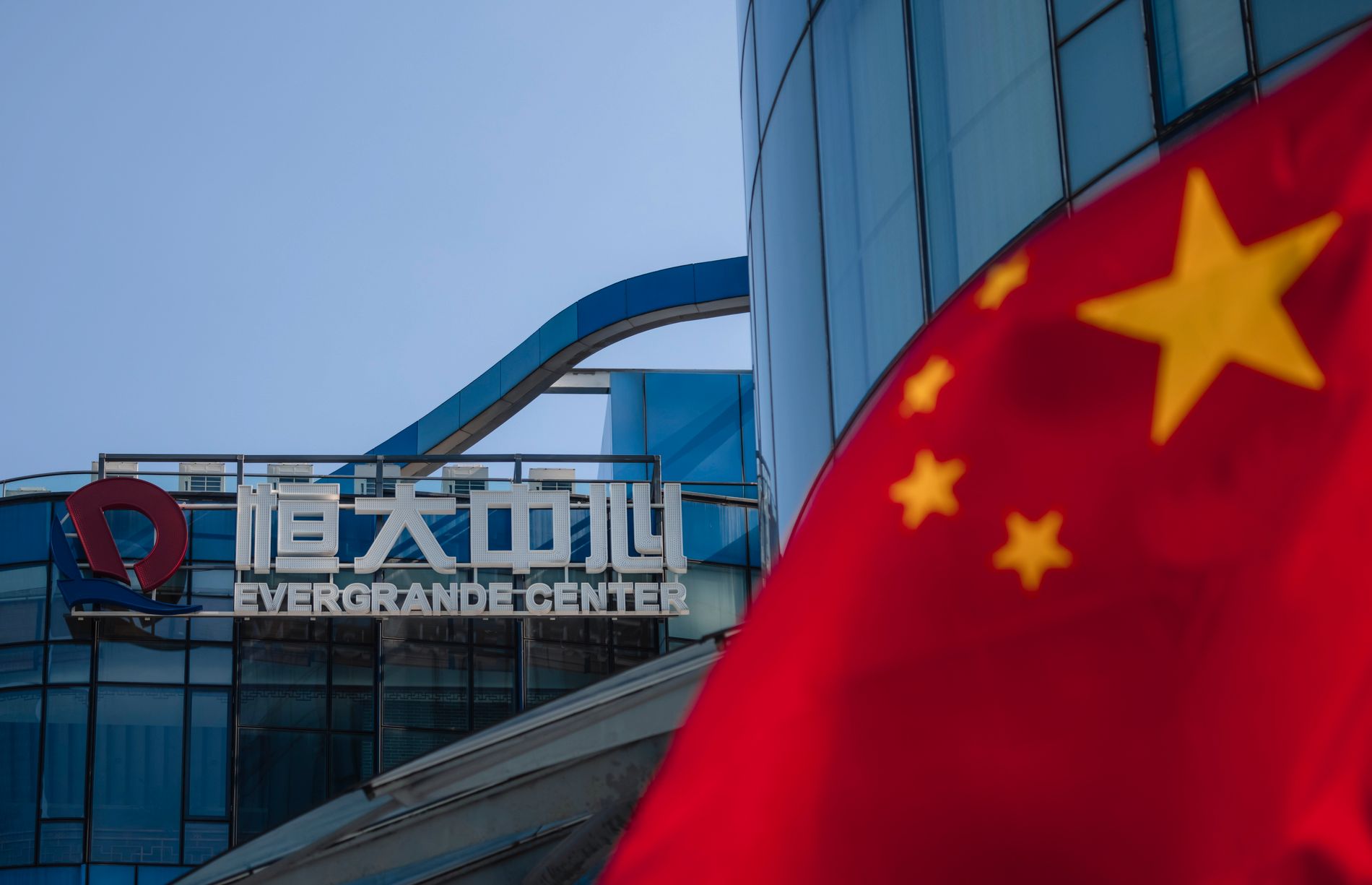

Everyone’s eyes were once again set on Chinese real estate giant Evergrande on Wednesday, which had a deadline to pay an interest deduction of $47.5 million, or more than 415 million kroner.

Now write both Reuters And Bloomberg That lenders should not have paid. In practice, Evergrande has 30 days from the due date until the loan defaults, according to CNBC.

Last week, the company also failed to pay bondholders by the deadline. Then it was the question of the $83.5 million in a $2 billion bond loan that went unpaid.

The company itself has not commented on the payment due from last week.

Evergrande is the most indebted real estate company in the world, with debts of over NOK 2.6 trillion. The company accrues a loan every month throughout the year.

Read also

Evergrande sells bank shares for 13 billion

I earned 13 billion in stock sales

However, Wednesday started off well for the real estate giant, which could announce that it has sold 1.75 billion shares in Shengjing Bank. The shares were sold for 5.70 yuan per share, which means Evergrande can raise just under 10 billion yuan, equivalent to more than 13 billion NOK.

The shares were bought by the state-owned Shenyang Xingjing Financial Investment Group.

The news sent Evergrande shares nearly 15 per cent on the Hong Kong Stock Exchange.

Read also

Briefly explain the Evergrande crisis

It may have global ripple effects

It is estimated that China’s real estate sector accounts for between 15 and 30 percent of the country’s economy. The crisis in Evergrande could thus severely damage the Chinese economy, which could also have ripple effects in the rest of the world.

“Things that happen in China are not going to be in China anymore,” Pål Ringholm, head of credit at Sparebank 1 Markets, told E24 in mid-September.

It became clear last week, when Evergrande caused a sharp decline in the world’s largest stock exchanges.

Read also

Bloomberg: Creditors cooperate ahead of Evergrande deadline

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”