It was another quiet day for the benchmark on Wall Street. There were no big moves one way or the other. This is how the exchange day ended:

- The S&P 500 rose by 0.23 percent.

- The Nasdaq Composite Index rose 0.36 percent.

- The Dow Jones rose by 0.03 percent.

half in one day

Under the hood of the index, individual stocks were seen to undergo significant moves.

Tingo Group, which provides fintech and agri-fintech in Africa, Southeast Asia and the Middle East, has plunged on Nasdaq after being butchered in a new report from research and short selling firm Hindenburg Research.

Hindenburg Research is notorious for downgrading shares of India’s mega Adani Group and hydrogen truck maker Nikola after publishing scathing reports alleging fraud. The companies disputed the charges.

Before the reports were published, the Hindenburg held short positions in companies with the aim of making money from falling stock prices.

Tingo Group shares fell nearly 50 percent on Tuesday.

“We’re short on Tingo because we believe the company is an exceptionally clear fraud with completely fabricated accounting numbers,” Hindenburg wrote in a report Tuesday.

I think it’s a hoax

The analysis firm believes it has found several red flags related to the founder’s background, including a fabricated resume.

Moreover, reference was made to, among others, a major launch of a food processing plant in Nigeria with multi-billion dollar investments, in which the country’s Minister of Agriculture was involved. Hindenburg believes he has discovered that the facility shown in the investor materials is actually an archive photograph of an oil refinery. The analysis firm also visited the construction site and found no indications of what the company described as significant progress in the construction process, according to the report.

Hinderburg also penalizes accounting practices, and notes that in February the fintech company bought Tingo Foods from founder “Dozy” Mmobuosi for $204 million. The price roughly corresponds to the cost price of Tingo Foods inventory. The stock should have been entered in the annual accounts, but not in the first-quarter numbers, according to the Hindenburg.

“Our experience suggests that $204 million in stocks don’t just disappear from companies with real internal controls and financial reporting,” the research firm writes.

This spring, Tingo Group’s share doubled in a short time, but since the peak in mid-May, the share price has collapsed.

DN has not yet been able to obtain comment from Tingo Group.

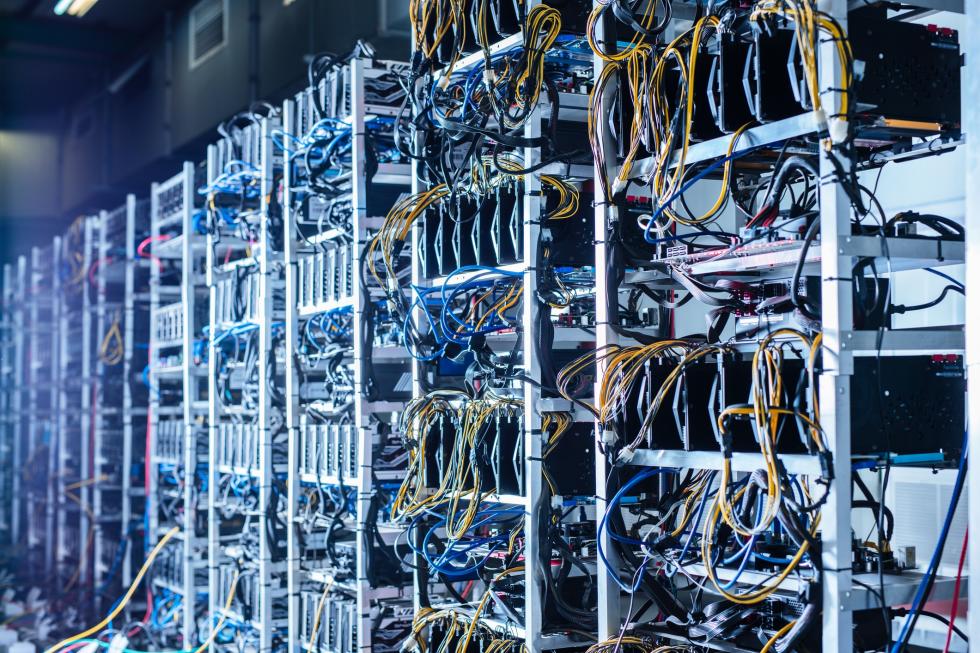

Cryptocurrency exchanges fell

Coinbase stock fell 12 percent after the US Securities and Exchange Commission (SEC), the US financial regulator, announced a lawsuit against the cryptocurrency exchange.

It has been less than a day since a similar message emerged that the SEC will prosecute the world’s largest cryptocurrency exchange Binance for market manipulation and conflict of interest. Also in the case of Coinbase, there is talk of a breach of securities law.(conditions)Copyright Dagens Næringsliv AS and/or our suppliers. We’d like you to share our statuses using links that lead directly to our pages. Reproduction or other use of all or part of the Content may be made only with written permission or as permitted by law. For more terms see here.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”