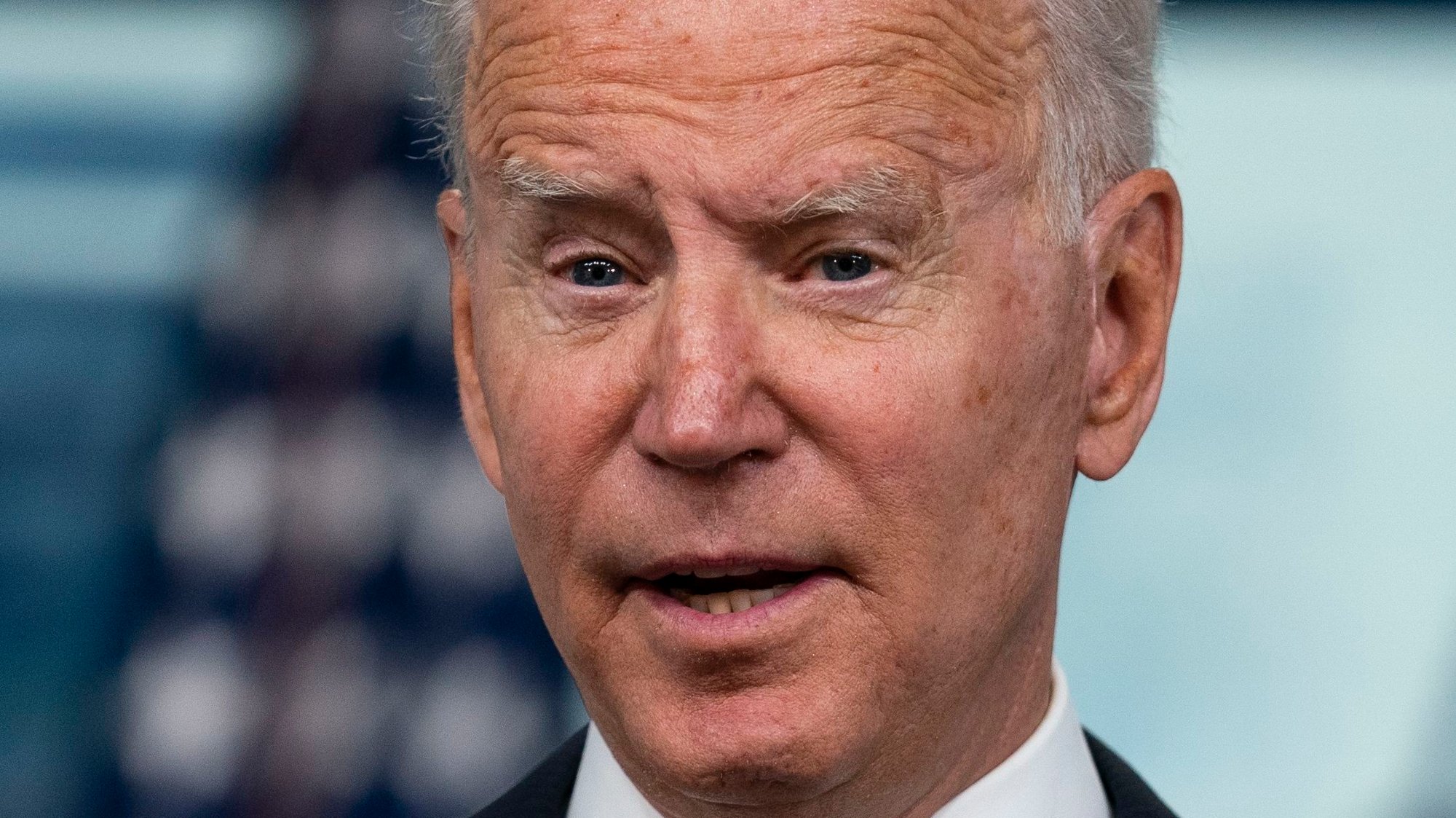

Recent statistics are a stumbling block for President Joe Biden.

NEW YORK/OSLO (Nettvizen): Several recent numbers released in the US on Friday represent a slowdown for President Biden.

– Big disappointment

First, the latest US employment numbers in August were much worse than expected.

Figures released by US statistical authorities on Friday show that non-farm payrolls increased by only 235,000 people in August. The unemployment rate in the United States was 5.2 percent at the end of the month.

Read also: Supreme Court demands Biden’s resignation: – May God help us

– Big disappointment, he writes CNN About the new numbers.

The number is also disappointing on Wall Street, and both the Dow Jones and the S&P 500 are starting to decline.

Biden angry at poll

recent poll from ABC News/Washington Post Which was published on Friday, also shows that those who think President Joe Biden is doing a good job is now down to 44 percent, down from 52 percent in April.

Read also: Now one wonders if Biden is fit to be president

Those who believe Biden is doing a bad job are now at 51 percent, up from 42 percent in April of this year.

500,000 less

So far this year, job growth outside of the agricultural sector has averaged 586,000. Growth has primarily come in academic occupations, transportation and warehousing, but also in private education, production and other service industries.

In other words, the height was wide. In August, there was a decline in commodity trade.

Read also: A new study: The Pfizer vaccine is clearly less effective than the Moderna vaccine

According to Handelsbanken, total employment was expected to rise by 750,000, after a huge growth of 943,000 in July. The unemployment rate was expected to fall to 5.2 percent, down marginally from 5.3 percent in July. Check this prediction.

Read also

Supreme Court demands Biden’s resignation: – May God help us

The bank wrote in the morning that even if the forecast turns out to be correct, there will still be just over 5 million fewer employees in the United States than there were before the coronavirus pandemic. At the end of August, about 8.4 million Americans were unemployed.

Not surprisingly, there has been a significant drop in unemployment from peak levels in the spring of 2020, but pre-corona unemployment was at 3.5 percent and 5.7 million Americans are without a job. The so-called neutral unemployment, which is unemployment that does not lead to wage and price pressures in the economy, is estimated to be around 4 per cent.

Read also: – Now one wonders if Biden is fit to be president

The most important in the world

US employment figures are often referred to as “the world’s most important key figures”.

In Friday’s morning report, DNB Markets merely refers to them as the “most important numbers of the month”. Then they ask the inevitable question: Why is this particular number so important to the financial markets?

The obvious explanation, according to the brokerage, is that the US labor market means a lot to the US Federal Reserve and monetary policy. This applies to both the form of stock purchases and the principal policy rate.

Read also

Now one wonders if Biden is fit to be president

For now, the numbers are pretty significant, according to DNB. The central bank said that a significant improvement in the labor market would mean that purchases of securities could be curtailed. During the Corona crisis, the Federal Reserve bought a lot of securities to keep interest rates low and increase liquidity in the market.

stands and falls

Reducing the volume of these purchases is in line with the development in the labor market. DNB wrote in the morning that if today’s report turns out as good as forecasts (they are employing 725,000 new jobs, editor’s note), the downsizing could begin later this year.

The brokerage believes that will happen in November or December, and that there will be a reduction over eight months.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”