Decentralization: Gold or cryptocurrencies are not controlled, produced or distributed by a central authority and therefore may be less vulnerable to political/regulatory risks. However, the cryptocurrency market is being watched with suspicion by authorities in many countries, and is at risk of regulation in the future.

Differences between Bitcoin and Gold

Materialism vs. Digital: Gold is a physical asset, used for example in electronics and jewellery. Bitcoin is a purely digital asset, which is stored on the blockchain.

Mobility: Gold is heavy and not suitable for physical transport, while digital currencies can be moved quickly or transferred electronically.

Dividability: It is possible to break a gold alloy into smaller parts, but it requires an industrial process. Bitcoins can be divided into “satoshis” which enable microtransactions.

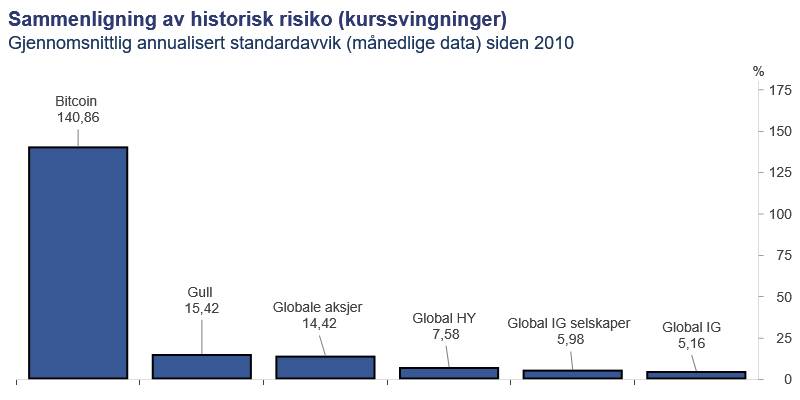

Volatility: Gold is (perhaps somewhat incorrectly) considered to be a stable store of value, while cryptocurrencies such as Bitcoin (launched in 2009) have seen very large fluctuations in value.

Promise to have a little fun: Chief strategist Christian Lee opens the door to a little “financial entertainment” in the portfolio. Image: Fortune

Safety vs. Speculation?

In recent years, we have seen the value of Bitcoin increasingly fluctuate in line with risk appetite in the financial markets. As in 2021 and 2024, largely driven by interest from private investors, but also institutional players. Periodic extreme increases in the value of Bitcoin and other cryptocurrencies become self-reinforcing when “everyone” wants to participate. Publicity in social and traditional media has a reinforcing effect and increases the risk of a bubble. Although largely traded as a “low-risk investment,” gold can also be affected by the same forces. When something rises in value a lot and receives publicity, interest and demand increase, which in turn raises prices to irrational levels.

What is driving development now?

In addition to psychological factors in the market, the price of both gold and Bitcoin can be affected by fundamental factors. Neither gold nor cryptocurrencies provide any form of direct return or cash flow. The return depends on the turnover occurring at a price higher than the price at which it was purchased. The lack of inherent value creation creates sensitivity to “opportunity cost,” i.e. the theoretically forgone risk-free return. US government interest rates are often used as a reference. Therefore, there were several periods when rising interest rates affected the prices of gold and cryptocurrencies. Central banks are now expected to cut interest rates in the future as an explanation for gold and cryptocurrencies' records.

Politics comes into play

Another common explanation for this rise is geopolitical tension. This could lead to economic and financial shocks, as well as repercussions on major currencies, such as the US dollar. Therefore, investors are looking for other ways to preserve their values. For Bitcoin, the price rise was fueled by the launch of Bitcoin exchange-listed index funds. According to the Wall Street Journal, the ten largest Bitcoin funds in the United States have reached $50 billion in total assets under management.

If you want to invest in gold, you do not need to buy physical gold. Listed index funds provide exposure to the price of gold, and are funds that must lock in value in physical gold. One of the most important price drivers is the demand for physical gold, especially from emerging economies. China and India represent about two-thirds of global demand, while the rest of Asia and the Middle East account for another 25 percent. India is currently witnessing a boom in its economy and financial markets. Increased prosperity contributes to increased demand for gold. In China, families save 35% of their income and are reluctant to invest in real estate and stocks. Gold becomes an attractive alternative. The tense relationship between China and the United States contributes to the fact that Chinese authorities prefer to place new foreign exchange reserves in gold rather than in US government bonds.

Illustration: Macrobond/Phormio

There had to be a “but”!

In my January 2022 article “Faith, Hope, and Cryptocurrencies,” I argued that cryptocurrencies do not pass the litmus test for inclusion in a long-term investment portfolio. I'm not opposed to having a lower percentage of gold and/or cryptocurrencies, just not as main ingredients.

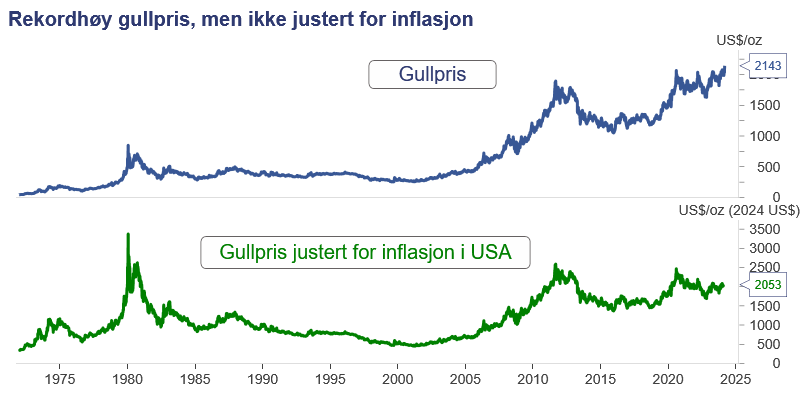

Neither gold nor cryptocurrencies provide direct returns or cash flow like bonds, nor do they pay dividends like stocks. Any return depends on the transaction. Although gold and cryptocurrencies are said to provide protection from inflation, this particular track record is questionable. The average correlation between gold and US inflation over the past 50 years has been 0.16, in other words, the development of gold's value has been close to independent of price growth. Although the price of gold reached a nominal record today, the inflation-adjusted record since 1981 still stands. Bitcoin rose alongside US inflation from the summer of 2020 until November 2021, but then fell by 75% of its value through November 2022. The recent recovery coincided with a sharp slowdown in inflation.

One of the most important benefits of investing in stocks is their connection to economic growth and company profits. Neither gold nor cryptocurrencies have this close correlation, and thus lack the same real economic forces driving values to rise over time.

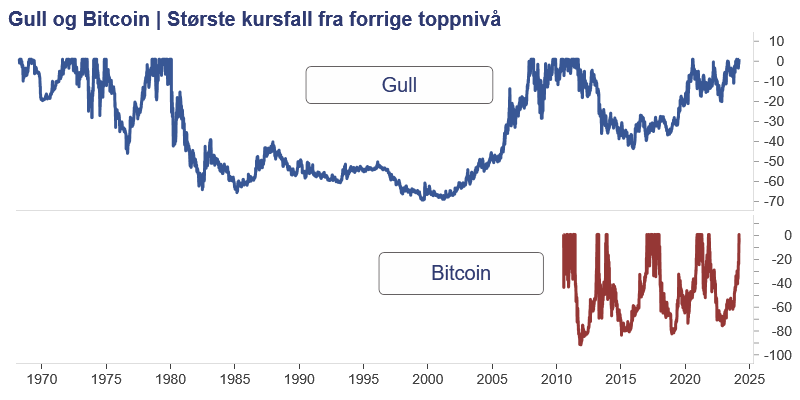

Do gold and cryptocurrencies have a good enough risk-return ratio? Portfolio components should not only have a low correlation with other components, but also generate a return good enough to defend their risks. Gold price movements are not always easy to explain and gold has not always been protected from inflation. Since its peak in 1981, the price of gold fell by at most 70% until 1999, and did not reach a new nominal price high until 2008. Bitcoin has achieved periods of extremely high returns, but at extreme risk. At the last six lower levels, the decline in value from the previous peak was respectively 90 percent (2011), 83 percent (2015), 73 percent (2020), 52 percent (2021) and 76 percent (2021). 2022).

Illustration: Macrobond/Phormio

What does this mean for you?

In my previous comment I warned against letting greed control investment decisions. Sure, both gold and cryptocurrencies are up in the air, but that doesn't mean you should get carried away. Often, investments that rise in value a lot get media attention at the end of their rally. In a long-term and semi-boring portfolio, it is still permissible to allocate a smaller share for “financial entertainment”.

Neither gold nor cryptocurrencies should be written off outright, but I would argue that they still lack some of the most important qualities to be in the driver's seat of a long-term investment strategy.

Illustration: Macrobond/Phormio

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”