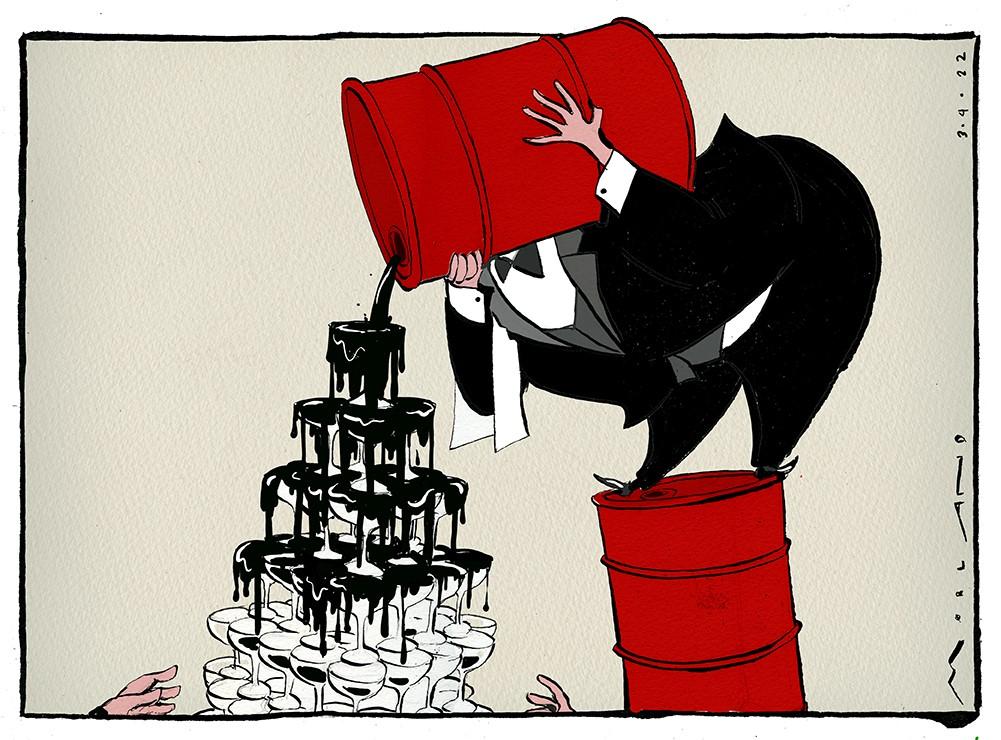

We know how it tends to end when oil prices are hovering above $100 a barrel. And this time it could be even more dramatic.

This is a comment

The comment expresses the author’s position.

As a motorist, it’s tempting to look away from the counter at the pumps. As an energy consumer in a separate home, it is probably best to maintain mental health by keeping the fuse box closed.

Regarding the energy crisis, consumers in both Berlin and Voss are grumbling. Even before the war, electricity, gas and oil prices were high. Putin’s rumble and lack of investment in oil and gas over the years have contributed to this.

As long as the autocratic Putin clings to power, there is now little reason to believe that sweeping Western sanctions will be lifted. Extremely high gas prices in Europe will have a negative impact.

Even if the war ends tomorrow.

Today’s oil prices above $100 per barrel are also very profitable. Some analysts also do not rule out prices in excess of $200 a barrel in the future. They could always be right – for example, if the emerging sanctions against Russian oil became more comprehensive.

At the same time, we have to remember how volatile energy prices are. As recently as the pandemic spring of 2020, the price of oil was at one point in the red. The point is, we shouldn’t believe what’s happening here and now, which gives us facts about the way forward. nothing lasts forever.

Perhaps the oil and gas producers, who are now disappointing huge sums of money, know this, too. We hope Equinor investors know this as well, as they continually reach new stratospheric levels on the exchange. Many would also theoretically realize that in years like 1974, 1980, and 2001, sharp increases in oil prices contributed to a global recession.

Thus, higher energy prices can shrink economies. Buyers disappear when prices go up too much. They find alternatives, or they reduce consumption. The car remains stationary.

Many numerologists believe that higher commodity prices this time too could make the world spin slower. Growth will slow. And some pessimists go even further. They all see a pattern as it was during the financial crisis. At the time, we were making roughly $150 a barrel of oil. And therefore economies cracked.

The former oil-friendly International Energy Agency (IEA) also dumped itself after Putin’s brutal invasion. One Ten point plan How to reduce dependence on oil immediately. Estimated world oil consumption this year is lowered.

All this has a hint of the oil crises of the seventies.

For those who lived at the time, the experience must have taken hold. Several Arab oil countries went to boycott and besiege Israel and the West. Oil prices have skyrocketed and we have plowed up prices.

In Norway came the car-free days. Gasoline had to be saved. The king took the tram at Anorak. And in many countries, people bought more fuel-efficient cars for years afterward. Oil prices have suffered for a long time.

Read also

The Russian war is changing energy policy in Europe

Then history rarely repeats itself. Note that we live in a different world now. The oil options are actually much more than that. the influence maybe Over time it becomes more powerful than before.

Take the batteries. They develop quickly. Or see what glitters. In many places on the planet, solar panels are everything cheapest way to generate electricity.

And with energy prices soaring, it becomes easy to count more sun and more wind (although wars and epidemics in and of themselves make developments temporarily more expensive).

Or take cars. A few years ago, electric cars were mostly a little bit eccentric, and Elon Musk, the wealthy Americans and subsidized Norwegians were doing just that.

has now We are electric scooters in major cities and Electric car sales that take off in country after country. Self ferries And the trucks Little by little on hydrogen. Modern nuclear energy is gaining increasing support. The true, low-emission green alternatives will only increase over time.

So this is not a straight line. Oil is used today in an incredible number of products. Not everything can be replaced today or in 2025. However, there will be global demand for oil. It’s a long time until we see the last oil.

Unfortunately, in the short term, war is also likely to contribute to increased emissions – above all from climate-damaging coal.

Energy investments also require patience. Renewable energy can replace few short-term fossil needs. The contribution of more sun and wind this year will be marginal.

Read also

This is how the International Energy Agency will reduce the consumption of oil in the world

But in the long run, you will feel the huge ambitions renewed. at The European Union, among others. Development plans were accelerated in the wake of Putin’s brutal attack. Now it is also about energy security. became renewed “Freedom Energy”.

At the same time as the green money is pouring in, the oil companies are in trouble. Those who invest heavily in fossil production over the coming decades risk settling the bill without a host. Because here, too, it will be years or decades before the investments provide significant new production.

Maybe more oil just when a piece of oil demand is gone? This also applies to the Western oil giants. So far this year, it has released a few hairy new developments.

The situation is different for some Arab countries. And the president of the United States is just one of many working in the short term to start ambitious oil investments in the West as well. But Joe Biden struggles to persuade. The oil managers themselves are experienced enough to know that prices can go down.

At the same time, no one is able to predict the cost of oil and gas in 2030 or 2040. If fossil investments become small over time, oil prices can be high even on the day when demand properly begins to collapse.

Over time, however, high oil prices became the worst enemy of the oil enemy. There were no more alternatives to black gold.

Read more comments:

Read on E24 +

nervous tension

Read also

Mortgages can fluctuate interest rates

Read also

Small percentages of the West can break Putin

Read on E24 +

Smells like a tiny artificial belly from Aker’s Herøya

Read on E24 +

Stocks of smart brains that can rise

Read on E24 +

Strong market forces can lift stock markets

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”