A long road from criticism to concrete policy.

It is an opinion

Comment expresses the writer's position.

What does a potential capitalist victory actually mean in terms of tax policy – with the Conservative Party being the dominant party?

Right now, Høyre's policy is in preparation, but a decision may already be reached. More on that at the end.

First, five points about tax policy that could affect Norway from 2025:

1. Echo … Echo … Echo …

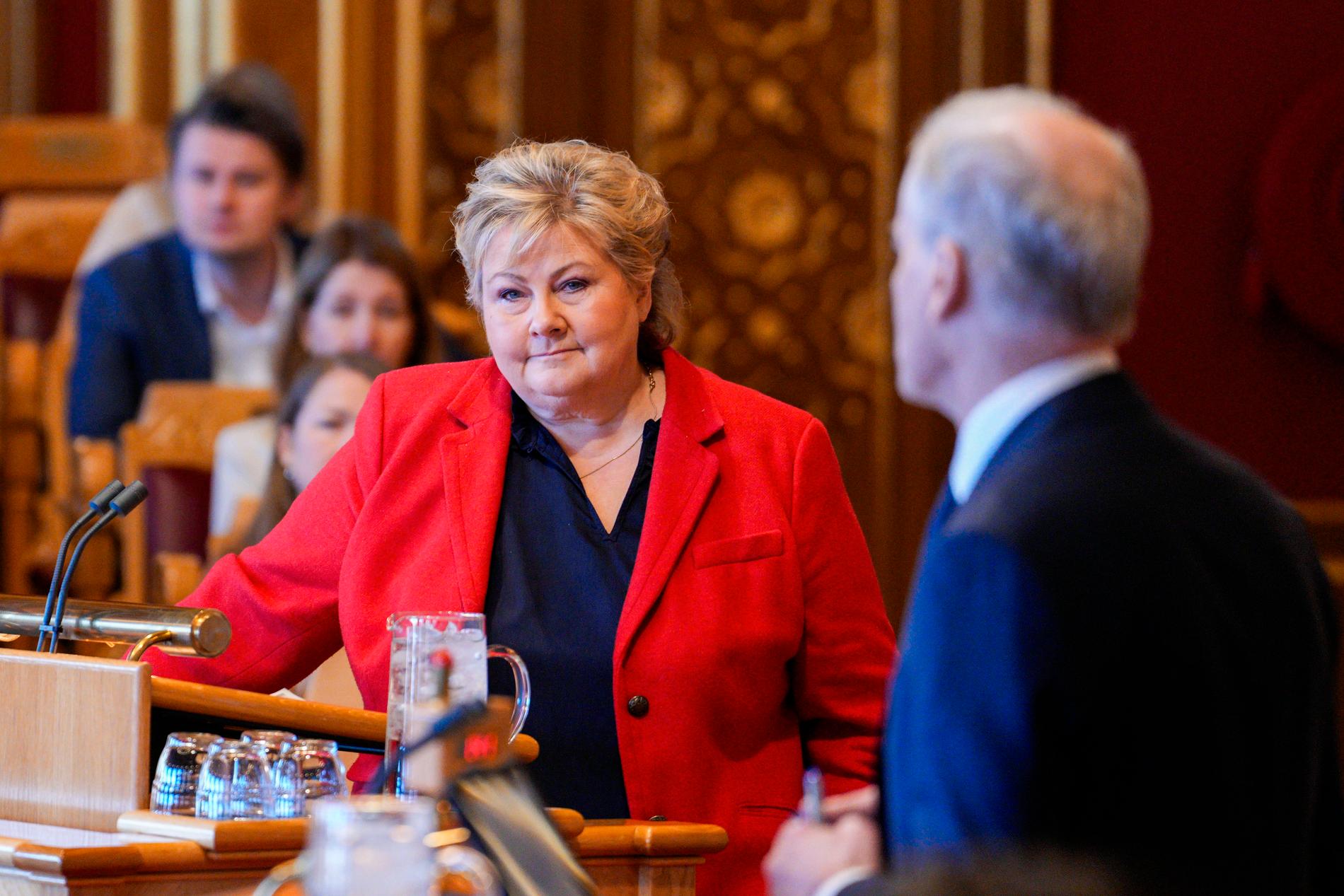

On the surface, tax may appear to be a contentious issue in the Conservative Party. Tax concessions are the party's DNA. Even so, it has often been hot. In 2020, when the Conservative Party's national conference voted to abolish the wealth tax entirely, Erna Solberg reneged on the promise. A few days later (Way: I was then a minister and attended the national meeting).

Parties can become echo chambers. Currently, “everyone” who wants low taxes is the media image (Switzerland!) and the majority of people feel they have them. But Høyre's strategists know that won't last.

Tax benefits should be factored in and costs should be compared to other investments. Prominent figures in the party are worried about painting themselves into a corner, especially over property taxes.

At the same time, the Conservative Party is also a feeding trough for other capitalist parties. If the party gets too weak, both the Progressives and the Liberals are starving for voters.

2. High but broad expectations

Many people – from the business world and not least in the areas around Høyre – expect clear and distinct tax promises. But what about most people?

Although Income tax has remained unchanged or decreased for most wage earners With Støre and Vedum, inflation and interest have hit the wallet hard. Many voters will like promises of better private finance from the Conservative Party.

For the business world, the franchise tax journey, ie wealth tax wealth tax “Wealth tax is a tax on net wealth. Net wealth is the value of assets minus debts. In other words, wealth tax is after deducting the total value of various assets such as real estate, bank deposits, stocks and business capital. There is debt.” Source: Great Norwegian LexiconAnd Dividend taxDividend taxDividend tax is a tax on stock dividends to individual shareholders, i.e. money taken from a company to one or more individuals. A very important theme.

The Krone in reduced wealth tax cannot be used simultaneously to provide better private finance for most people.

At the same time, priorities are becoming more difficult because:

3. The room for tax relief is really getting smaller

For two reasons:

First, because we are in a period of increasing costs. The aging wave The aging wave The elderly population is increasing rapidly. This is due, among other things, to the high birth rate after World War II. Here it is. Both social security spending and healthcare spending are increasing as the population grows. Be defensive and prepared And eat more of budgets.

The second reason is political. The public sector is very large in Norway. Tax levels are high and we use more oil money in annual budgets. However, the appetite for tax cuts outweighs the willingness to swallow spending cuts.

Right-wing vice presidents have also said they want to Strict, not overly generousRules for future use of oil money.

Read on

Don't trust the government's tax promises

4. There will be more about tax transfer

It means that some taxes and levies increase while others decrease. This means, for example, that a reduction in wealth tax is “paid for” by increasing some other tax.

The Planning Committee has constituted a separate tax committee. One of the discussions was about session Corporation taxCorporation taxCorporation tax is a tax that all companies pay on their profits. It currently stands at 22% and has fallen in recent years under both capitalist and red-green governments. , which all corporations pay, can pay for reduced franchise taxation. However, it is more difficult than it seems.

Both right and left have agreed to cut corporation tax in recent years to ensure Norway remains attractive to foreign companies.

If corporation tax rises, dividend tax should also be changed to avoid a higher tax bill for owners. In that case, it costs money.

5. The gap must be closed

It is notable that Høyre's rhetoric has so far placed more emphasis on predictability (and criticism of the government) than concrete tax promises.

At the same time, the party has been high and dark on some personal matters. They promised recently Get back the government's new exit tax. During the loud debate over the salmon tax, the Conservative Party raised expectations in many farming municipalities – but without clear promises about the future.

Demands for the Conservative Party to close the gap between rhetoric and reality will become clearer as the general election approaches.

One conclusion can already be drawn: some will be disappointed by what the Conservatives finally put forward.

The undersigned was a minister from 2013-21 but left the Conservative Party when I joined E24.

Read on

Hanging salmon line hope

Read on

On a treasure hunt for peace

“Music geek. Coffee lover. Devoted food scholar. Web buff. Passionate internet guru.”