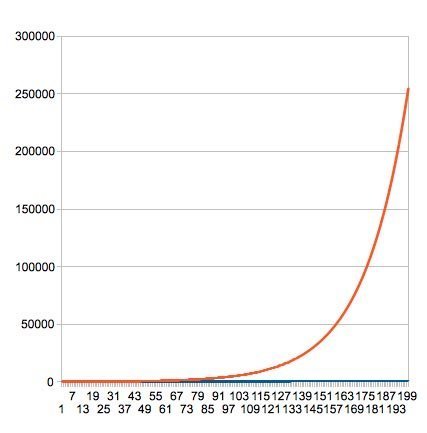

Most people find it difficult to distinguish between linear and exponential growth. They see 4% growth as a straight increasing line moving steadily forward. This is because they think from a short perspective. The linear curve and the percentage curve are not much different in the early years. We call it the difference between an arithmetic series and a geometric series. The geometric row ends with a curve heading directly towards the sky. This is why all interest-based systems eventually collapse. Hence the assumed growth targets Net zero A mathematical and physical impossibility.

Hans-Erich Olaf explained this thoroughly in the article The drop that makes the cup overflow.

Here I would like to add two points on the same street and point out that the current regime must collapse, and our rulers know this too, because this is exactly what they are heading towards. What they tell the fans is a completely different story.

If we have 4% growth per year, the quantity from 100 will rise to 122 after five years. If we converted it to linear growth (increasing 4 units each year), we would have 120 units after five years. The difference is quite minimal and he doesn't have much to say in such a short period of time. After twenty years, the linear growth will reach 180, while the percentage growth will take us to 219. The difference is starting to become clear, but it is not dramatic. With 4% growth, it only starts to take off after 40-50 years. After 50 years, the linear growth reached 300, while the ratio reached 711. From there things accelerate. If we add another fifty years, the linearity will reach 500, while the ratio will reach 5050. An economy that grows linearly, in our example, will become five times larger in 100 years, but grow at 4% per year. It will become fifty times larger. I have an uncle who will be 100 years old soon, so that's a number I can relate to. I have a grandson who could be 100 in 2099, so if Norway has 4% growth over his lifetime, he will be able to turn 100 knowing that the economy is 50 times bigger than it was when I was in 2099. He turns 50.

Norway for two hundred years

I want to move forward another century. In 2014, Norway's constitution was 200 years old, so it's a number we can relate to, even if we don't know anyone born in 1814. Now young Norway saw almost no growth in its first decades, but let's keep looking at What would have happened if the country had achieved 4% growth since then? If we were talking about linear growth, the economy would have become nine times larger in 200 years, which is an understandable number. If we were talking about 4% growth per year, the economy would be 2,550 times larger. Two thousand five hundred and fifty times! It is an incomprehensible number, and an impossibility.

The difference between linear and exponential growth (here 4% more than 200 years.)

Calculate!

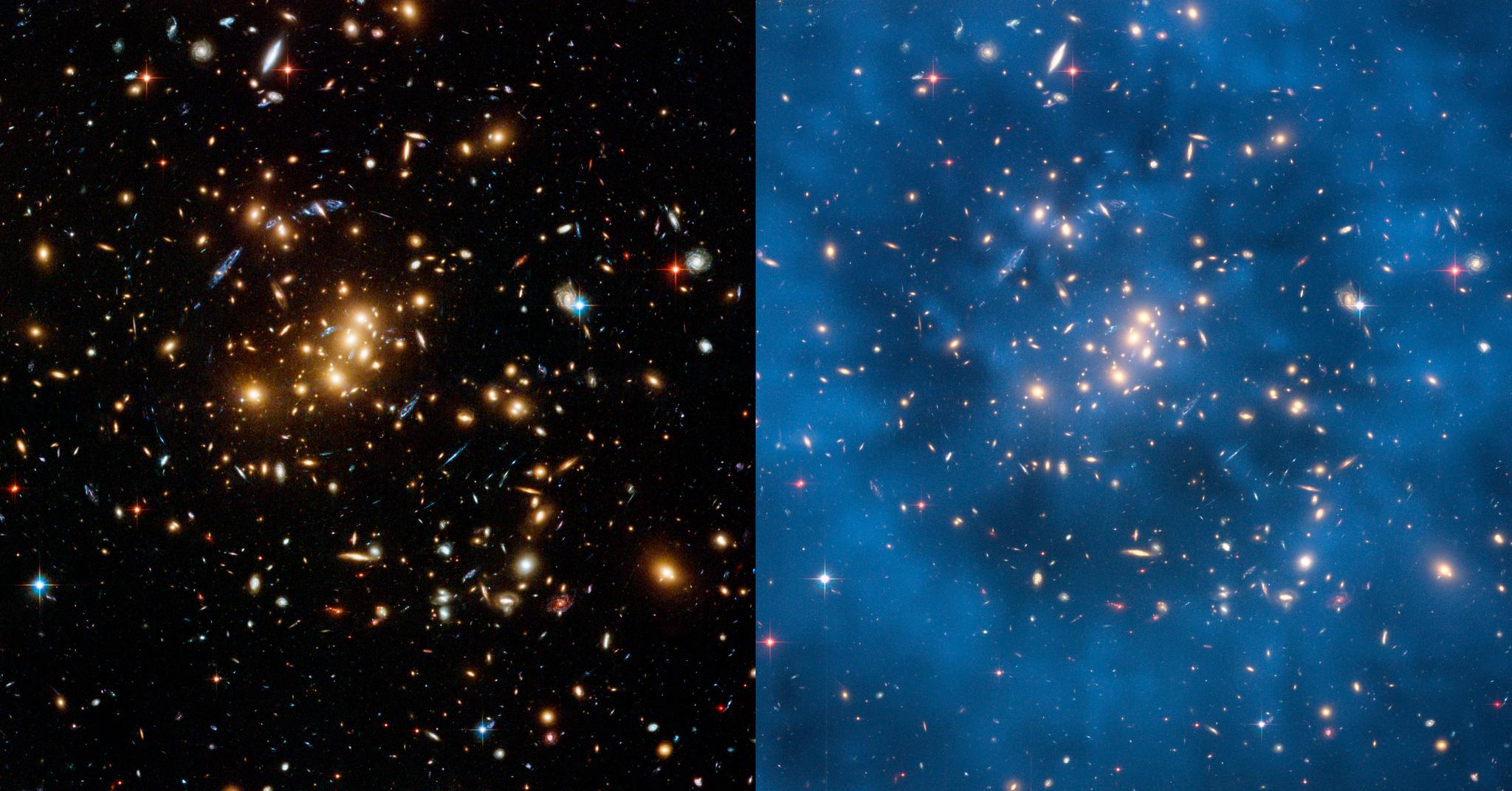

Is it getting dark? It is all well and good to deal with relative growth over a few decades, but over a few generations it becomes impossible. Astrophysicist and mathematician Tom Murphy We have calculated that if on Earth we have a growth in energy consumption of 2.3% in the first year fourteen hundred years, Will we have to produce more energy from the sun, and the surface of the Earth must have one energy The surface temperature is higher than the surface temperature of the Sun.

The biggest crisis in the history of capitalism – camouflaged as a health crisis

In the article Why is the pandemic crisis the favorite crisis of capital? He writes Hovig synthesis:

In an interview on October 15. A new Bretton Woods moment Says the Director of the International Monetary Fund Kristalina Georgieva, in which it is placed $12 trillion in financial capital (credit or support) of which US$7.5 trillion was created by central banks. These 12 trillion make up about 14% of global GDP. This corresponds to approximately two to three years of credit supply through the previous normal channel, increasing the loan and debt pool. In addition, some productive capital is processed, so that the ratio between capital and the production of goods and services increases further.

In 2020 alone, the world's total debt increased by 32,000 billion dollars Due to the closure policy. Global debt has arrived $226,000 billion In 2020 it is now up to $306,000 billion. The global debt-to-GDP ratio is now 336%. In the past decade, debt has increased 100,000 billion dollars.

The war in Ukraine has prompted Western countries to increase their debt by a few degrees in order to pump thousands of billions of dollars into the arms industry. They put themselves into more debt. Then the banks conjure money out of nothing, and that is where we are today.

There is no material production in the whole world that can maintain this system. You must crash.

Physical impossibility

The World Economic Forum, the European Union and the Norwegian government want us to electrify the world and reach what they call net zero in 2050. We have proven this previously Net zero It will mean that the majority of humanity will starve to death. I will look at another aspect here.

Electricity requires a lot of raw materials, such as lithium, rare earths and other minerals, which are already in short supply. Here we will only look at a metal that has been used by humanity for thousands of years and is absolutely essential to any electrification process, which is copper. Calculations have been made on the number of cups needed to achieve all this, and it looks like this:

So: Net Zero assumes that in 25 years humanity will extract twice as much copper as has been extracted in our entire history so far. Here we do not delve into the amount of diesel that will be used in this mining operation. We are simply saying that this is an absurd impossibility.

In 2014, one was made Climate prediction For copper mining until 2100, it looked like this:

Copper production will be able to increase by 2030, but will decline since then, and in 2050 will not approach the targets required for net zero.

Our rulers know this. But why do they set impossible goals?

Yes, it's partly to trick the masses into accepting their agenda by promising us golden and green forests, and partly by formulas like the “green shift” to get a free hand on the most brutal plundering of the earth ever. For them, it's about power, profit and control.

The Babylonians invented mathematics and promissory notes. The art of writing developed in Babylon to keep accounts of debt obligations. The oldest written letters we have are cuneiform writing on baked clay. The accounts were written on wet clay tablets and then burned.

But despite their superiority in mathematics, the Babylonians knew that the continued growth of debt was bound to collapse. That is why they introduced the jubilee, meaning the cancellation of all debts, including the breaking of clay tablets every fifty years. Debt relief date.

The first known debt anniversary was conducted by Inmitina to Lagash c. 2400 BC.

And today's rulers will crush us too, not the debt obligations, but us

Read: In 2019, BlackRock presented a plan for the next crisis: – An unprecedented financial operation

The plan is presented in the document Coping with the next downturn: from unconventional monetary policy to unprecedented policy coordination.

In the document, it was pointed out that ten years of “quantitative easing” had not succeeded in creating the conditions for new growth. Central banks have pumped massive amounts of digital money into the economy, but there are still no signs of it easing. The interest rate level remained at zero or below zero. And in the financial crisis that was brewing at the time, that was the case There is not enough room for monetary policy to deal with the next downturn, books Black Rock Peaks.

The plan is presented in the document Coping with the next downturn: from unconventional monetary policy to

Unprecedented political coordination.

A summary of BlackRock's plan is available here.

In order to gain acceptance of pumping so much public money into financial markets, it was therefore necessary to “identify the extraordinary circumstances that would require such extraordinary coordination”, and so there has never really been a crisis that perfectly suits this purpose, namely the global financial crisis. – It's called the “epidemic.”

This was a financial coup against humanity.

This reversal is now being continued through the war economy and the “green transition” and will lead to collapse, famine and a new form of slavery.

If humanity does not wake up and rebel against the small ruling class behind this.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”