Electronic newspaper: Thanks largely to six interest rate hikes signed by Norges Bank, Norwegian banks were able to report record revenues in 2023. And that's a credit to many of the bank's employees.

Finansfokus wrote that DNB paid bonuses worth NOK 198 million in 2023. The newspaper wrote that the bonus for the group, which has 6,000 employees, was NOK 33,000. DNB also has several other bonus plans covered by different variants and individual bonus plans.

– This is a very good result to which all employees in our group contributed. Even if we do not achieve the higher target and the NOK 37,500 payout, we should be very satisfied with the NOK 33,000 group bonus. (..) This is the highest joint bonus ever, says Group Store Head Lilian Hatrim at DNB, to Financial focus.

DNB's annual report for 2022 shows that DNB CEO Kerstin Bråthen earned a fixed salary of NOK 8.29 million in 2022, plus NOK 3.17 million in bonuses. With the pension, the total remuneration amounts to NOK 15.4 million.

Overall, last year ended with profits approaching NOK 40 billion after tax for DNB. Operating profit before tax ended last year at a record level of NOK 53.1 billion. This is close to NOK 10 billion more than the previous year.

Dagens Narinsleeves The overview shows that SR-Bank employees receive a bonus of ten percent of their total fixed salaries. This is a lot compared to previous years where they received between 0 and 2.5 percent, while in 2022 they received 7.2 percent as a bonus.

While Sparebank 1 Gudbrandsdal gives bonuses worth NOK 50,055 to all employees. The bank improved its annual profit by NOK 28.4 million last year, DN writes.

Avisa has been in contact with Nordea, which will not comment on the bonuses.

– Doesn't look good

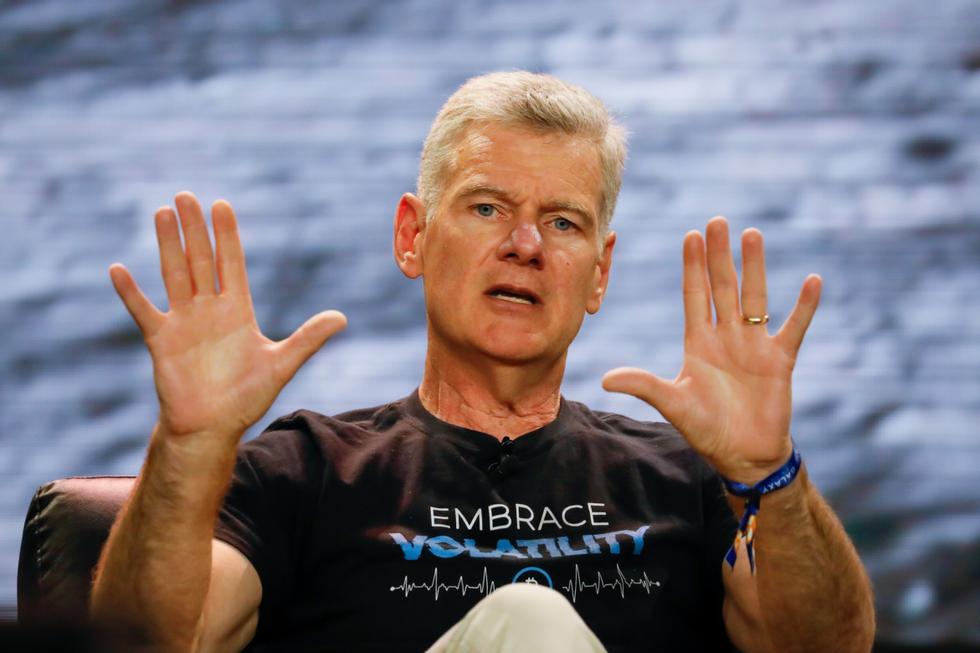

Deputy leader of the FRP, Hans Andreas Lemme, understands that people react to the fact that the entire bonus goes to employees.

He thinks the bank might have done well to consider giving private clients slightly better terms for deposits and loans.

– DNB must decide its own salary policy. But this is not going well at a time when the population is suffering from a price crisis as expenses have increased rapidly, Lemi tells Netavisen.

Lemi expects the government to be able to manage the power it has, given that it is a major owner of DNB.

He adds that people should have a conscious attitude towards changing banks and negotiating better terms.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”